Property Herald: Bungalow linked to saga involving former China tour guide Yang Yin sold for $22 million

- Mogul Research Dept

- Dec 1, 2025

- 3 min read

Introduction

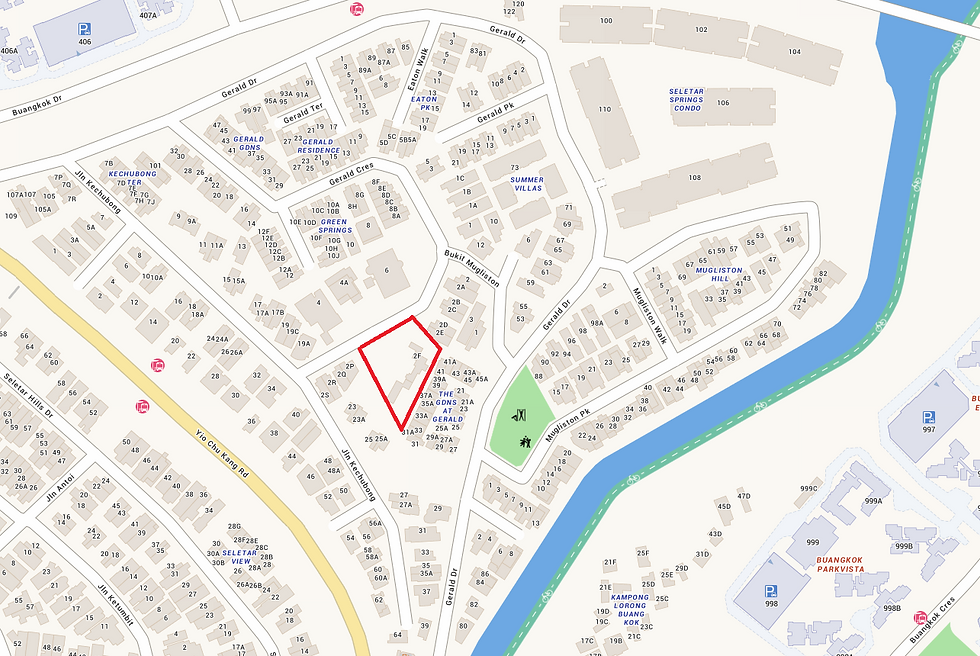

The residential land with a bungalow at 2F Gerald Crescent, off Yio Chu Kang Road, was sold at $22 million, based on a sale caveat lodged. Although the caveat was dated June 2025, the sale only caught the media’s attention this week.

The property is linked to the saga involving the former China tour guide Yang Yin who tried to get the property owner, Madam Chung Khin Chun, to let him inherit the property and all her assets in her will. Yang Yin was subsequently convicted and jailed for cheating and criminal breach of trust in 2016.

After regaining control of the assets with the help of her niece, Madam Chung and her niece put the property up for sale with an asking price of $35 million in February 2018, and again in January 2021 with a guide price of $25 million. The property was not sold on both occasions.

Sale of subject site

In June 2025, property with a land tenure of 999-year lease that started in 1879, was finally sold to a construction and real estate development company at a land rate of $690 psf of land

This land rate is significantly lower than the prices of other landed properties in the neighbourhood, which range from $1,560 psf to $2,360 psf of land, based on recorded transactions this year.

Reasons for comparatively lower land rate

The lower land rate of the subject property is due to the size, shape and the redevelopment potential of the land parcel.

Firstly, with a land area of 31,882 sq ft, the subject land parcel is several times the size of the typical landed housing plot in the neighbourhood of Gerald Crescent. The usual land area of the landed houses in that area range from 1,500 to 4,000 sq ft.

Secondly, the asking price of above $20 million is five to seven times the prices of landed houses in the vicinity of Gerald Crescent. It would price out many homebuyers seeking to purchase a landed house for their own use and occupation.

A potential buyer with a budget of $22 million to $25 million would have a wide range of housing choices, including luxury condominium units and houses in the CCR and Good Class Bungalows areas. The subject site is at District 28 in the northeast region of the Outside Central Region (OCR). Therefore, a buyer with a $22 million budget and looking to buy a bungalow may overlook this property.

Thirdly, the subject property has been in the market for the past seven years. Hence, after at least two tenders that closed without any buyers, selling the property at $22 million, which is 12% off the $25 million asking price in 2021, is not unreasonable.

A fourth reason is that the subject site is not squarish in shape, with heighten the challenges in the redevelopment of the property.

Therefore, the above reasons would increase the likelihood that the buyer of the property would be a real estate developer, rather than an individual buying the house for his own use. As the developer would factor in the development costs and profit margin, the offer price would usually be lower compared to the prices of the individual landed houses in the Gerald Crescent area.

Potential development

Based on the shape and location of the subject site, an efficient development strategy is to develop the site into a cluster housing development with about 10 to 14 terrace houses. A cluster housing project is a gated residential development with communal recreational facilities, such as a swimming pool.

We understand that the developer intends to build 6 units of semi-detached houses and 3 terrace houses with individual land title for each house, instead of a cluster housing development. The development plan would translate to an average land cost of $2.44 million for each house.

Such a development would require the developer to build access road on the subject site to provide road access to some of the houses that are not fronting Gerald Crescent, resulting in lower saleable land area for the developer. Construction is expected to start in the later part of 1Q 2026 to early-2Q 2026. The allowable building height in that area is 2-and-a-half stories.

Based on transactions of landed homes in the subject area this year, the prices of semi-detached houses range from $4.6 million to $6.4 million. In 2025, the land rate of resale landed houses in the northeast region, where Gerald Crescent is located, increase by 5.1% to $1,913 psf of land. The limited supply of landed properties coupled with the rising prices of condominiums is projected exert upwards pressure on the prices of landed homes next year.

Comments